China’s imprint on Africa’s developmental landscape has woven an intricate array of lessons pivotal for steering the continent’s future growth. As the Forum on China-Africa Cooperation (FOCAC) gears up for its 2024 summit, reflecting on the journey thus far is imperative.

I present five charts that encapsulate the evolving dynamics of China and Africa relations, serving as a precursor to what lies ahead in this pivotal collaboration. Though not exhaustive, these visual narratives are compelling enough to underscore the strides made since FOCAC’s inception in 2000.

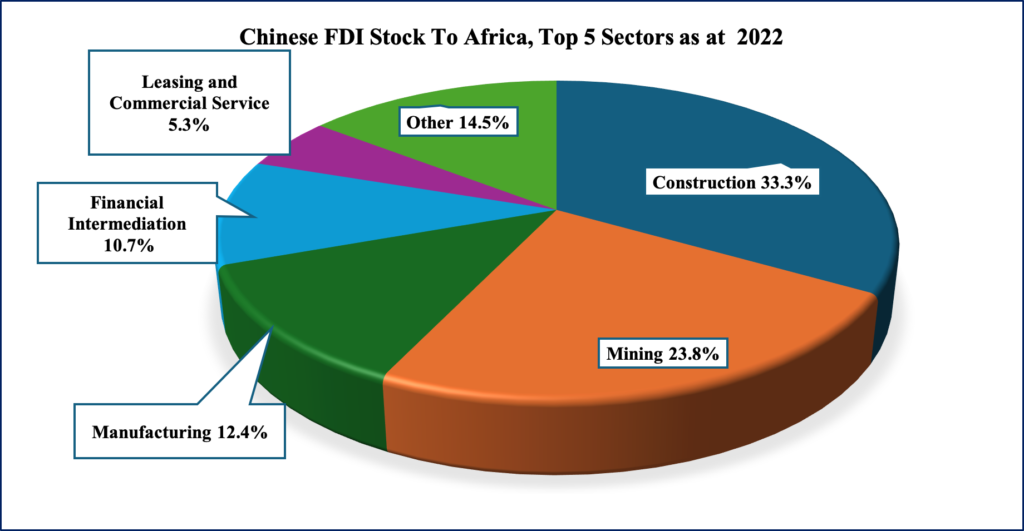

Chart 1: FDI Stock, Top 5 Sectors

The distribution of Chinese Foreign Direct Investment (FDI) across Africa reveals a strategic focus on sectors vital for infrastructure and economic growth. The largest share, 33.3%, is allocated to construction, highlighting China’s role in developing Africa’s physical infrastructure.

Source: Johns Hopkins University SAIS China-Africa Research Initiative

Mining, receiving 23.8% of the FDI, underscores Africa’s resource wealth and China’s interest in securing essential minerals and raw materials. The manufacturing sector, with 12.4% of the investment, illustrates efforts to diversify African economies and build local production capacities, reducing dependency on raw material exports.

Financial intermediation accounts for 10.7%, facilitating financial services that support business activities and economic growth. Leasing and commercial services, constituting 5.3% of the investment, further indicate the expansion of service sectors in Africa. The remaining 14.5% distributed among other sectors signifies a broadening scope of Chinese investments across various economic facets.

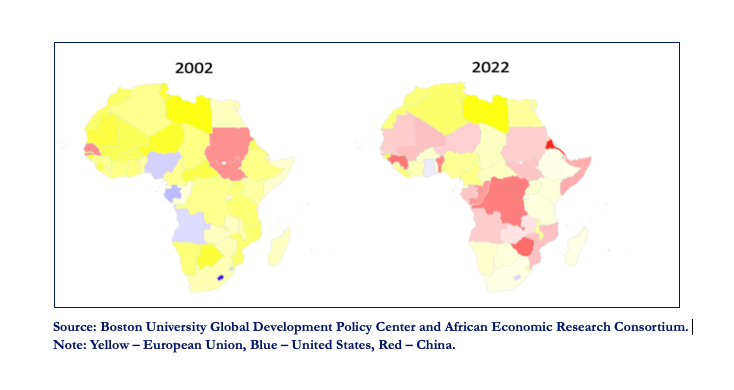

Chart 2: Change in Africa’s Lead Trading Partners from 2002-2022

Africa-China trade has experienced exponential growth, evolving from $11.67 billion in 2000 to a peak of $257.67 billion in 2022. This remarkable surge has positioned China as the leading trading partner for many African nations, overtaking traditional powerhouses such as the United Kingdom and the United States.

The shift is emblematic of the deepening economic ties and mutual dependencies that have developed over the past two decades. The trade relations are characterized by Africa exporting raw materials and importing manufactured goods from China. This relationship has fueled Africa’s economic growth and provided China with essential resources to sustain its industrial activities.

The diversification of Africa’s trading partners reflects a broader geopolitical realignment, with China’s Belt and Road Initiative further solidifying its presence and influence on the continent. This transformation also signals the potential for Africa to leverage these partnerships for technology transfer, industrialization, and economic diversification, ensuring sustainable and inclusive growth.

Chart 3: Africa-China Trade Balance, 2000-2022

While Africa-China trade has grown substantially, the trade balance has shifted from a relatively balanced state to significant trade deficits for African countries. From 2000 to 2022, the value of goods traded surged from $11.67 billion to $257.67 billion, but this growth has not been without challenges.

The trade deficit trend is partly attributable to Africa’s reliance on exporting raw materials while importing higher-value manufactured goods from China. This imbalance has been exacerbated during major global events such as the global financial crisis (2008-2009), the decline in commodity prices (2014-2015), and the COVID-19 pandemic (2020-2021).

In 2022, the trade deficit stood at 2.6% of GDP, highlighting the need for strategies to enhance Africa’s export capacity and value addition.

Addressing these trade deficits requires a concerted effort to boost local manufacturing, improve trade policies, and enhance the competitiveness of African products.

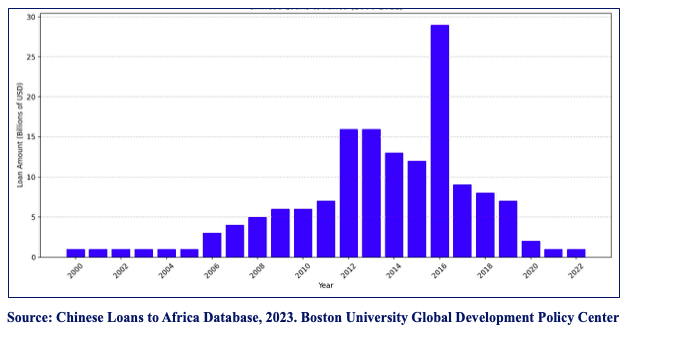

Chart 4: Chinese Loans to Africa, 2000-2022

Between 2000 and 2022, Chinese lenders provided an estimated $170.08 billion in loans to sovereign borrowers in Africa, with $134.01 billion sourced from China’s two primary development finance institutions (DFIs), the Export-Import Bank of China (CHEXIM) and the China Development Bank (CDB).

These loans have transformed China into Africa’s largest bilateral creditor, funding a myriad of projects ranging from infrastructure development to energy and telecommunications.

While the trend has seen a decline since its peak in 2016, the strategic deployment of these loans has facilitated significant infrastructural advancements. Indeed, the accompanying debt sustainability concerns necessitate careful consideration. Moving forward, there is a need for balanced financial arrangements that support development without imposing unsustainable financial obligations on African countries.

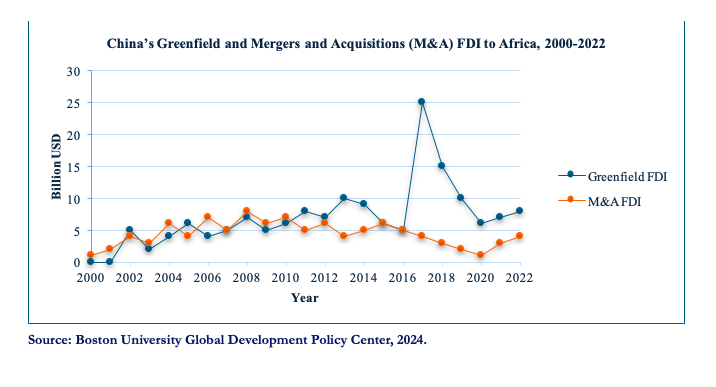

Chart 5: Greenfield and Mergers and Acquisitions FDI to Africa

From 2000 to 2022, Chinese companies announced $112.34 billion in greenfield FDI and completed $24.60 billion in mergers and acquisitions (M&A) FDI deals across Africa. Greenfield investments involve the establishment of new operations from the ground up, providing a direct boost to the host country’s economy by creating new jobs, developing infrastructure, and introducing advanced technologies.

These investments have been primarily directed towards industry, trade/services, energy, and non-energy mining and processing sectors.

On the other hand, M&A investments involve Chinese firms acquiring or merging with existing African companies, often leading to enhanced efficiencies, expanded market reach, and increased competitiveness. These investments have predominantly focused on the non-energy mining and processing and energy sectors, reflecting China’s strategic interest in securing access to vital resources.

While the distinction highlights the multifaceted approach of Chinese investment in Africa, it is worth stating that both forms of FDI are crucial for driving economic growth, fostering technological transfer, and enhancing productivity across various sectors.

Implications and Future Africa-China Relations

The data depicted in these five charts collectively illustrates the profound and multifaceted impact of FOCAC on Africa-China relations. The substantial FDI inflows, dynamic trade growth, and significant financial engagements underscore a robust partnership that has facilitated Africa’s economic transformation. However, the persistent trade deficits and increasing debt burdens highlight areas that require strategic adjustments and enhanced cooperation.

As FOCAC approaches its 2024 summit, the implications of these charts suggest a need for a more balanced and sustainable framework. Future policies should focus on increasing the value addition of African exports, promoting industrialization, and ensuring debt sustainability.

Strengthening local capacities, fostering technology transfer, and enhancing the competitiveness of African products are pivotal for realizing the full potential of this partnership.

Conclusion

In the words of an African proverb, “If you want to go fast, go alone. If you want to go far, go together.”

The journey of FOCAC over the past 24 years exemplifies the strength and potential of collective effort and mutual cooperation. As we look towards the future, the bonds forged through this partnership hold the promise of even greater achievements. The upcoming FOCAC summit is not merely a meeting but a reaffirmation of a shared commitment to progress and prosperity.

Just as a tree grows stronger with deep roots, the roots of Africa-China relations have grown deep and resilient, ready to support the weight of future ambitions. The twenty-four-year journey has been long, but the path ahead shines brightly with opportunities yet to be seized, ensuring that the legacy of FOCAC will be one of lasting impact and transformative change.

Written by: Isaac Ankrah, Ph.D., Senior Research Fellow, ACCPA