The 1981 film “Rollover,” featuring Jane Fonda, centered around a clandestine plot by oil-producing nations to abandon dollars in favor of gold, ultimately leading to a banking collapse, financial panic, and worldwide riots. Although a work of fiction, the movie conveyed a potent and perhaps prophetic message.

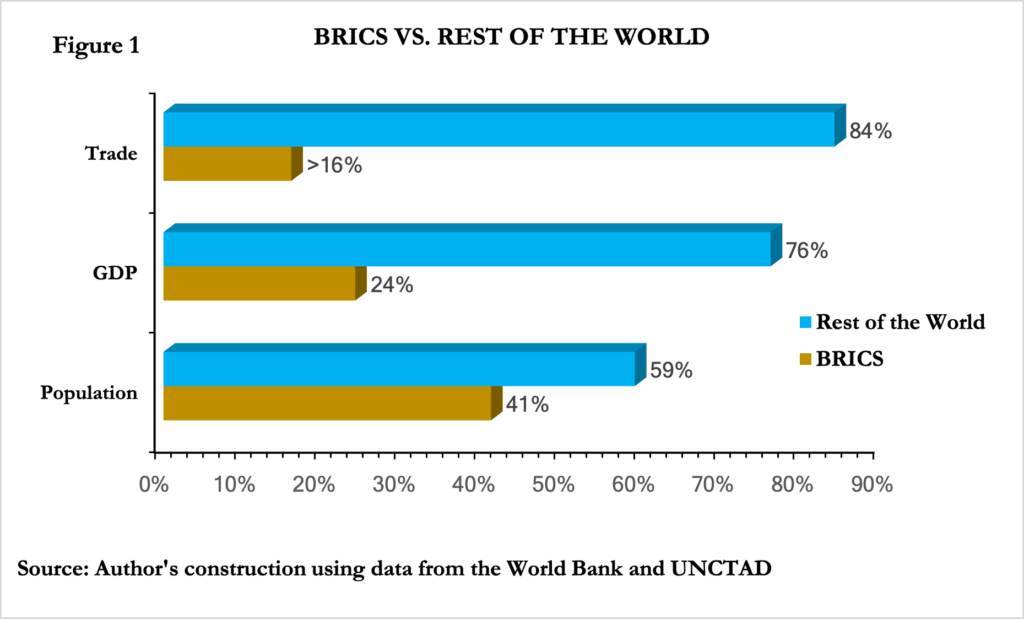

Merely a handful of individuals remember that the dollar nearly ceased to function as the world reserve currency in 1978 when inflation and trade deficits gnawed at its value and credibility. Several decades on, ditching the dollar as a reserve currency appears rational. Nations have begun to explore inventive methods to fortify their trade ties and bolster economic stability. At the forefront is BRICS, an acronym for Brazil, Russia, India, China, and South Africa. These are the largest emerging economies in the world, representing 41% of the world’s population, 24% of the world’s GDP, and more than 16% of the world’s trade (see Figure 1).

In January 2023, BRICS floated the idea of a common currency, marking the first indication of a potential challenge to the dollar’s hegemony. Russia’s foreign minister had issued a statement, saying “serious and self-respecting countries are well aware of what is at stake and want to create their own mechanisms to ensure sustainable development.” The idea is now gathering steam, and reports suggest that a proposal is in the works, likely to be taken up during the BRICS summit in South Africa this August.

The Plan and the main character

The initial step involves shifting towards settlements in national currencies, followed by the introduction and circulation of digital or alternative forms of a radically novel currency in the imminent future. Intriguingly, this strategy appears to have progressed significantly. For example, India has forged an accord with Russia known as the rupee-ruble trade mechanism. India compensates for Russian goods in rupees, whereas Russia receives rubles. They achieve this through specialized Vostro accounts, resulting in a surge in bilateral commerce. Brazil has followed suit by consenting to trade with China using their respective currencies. There are about 19 other countries that have expressed interest in going the “Brazilian way.” The main character in this unfolding narrative is China.

The blueprint for the BRICS currency may not come to fruition without the second-largest economy in the world. This observation is not a jab at the other nations but rather an acknowledgment of China’s wide-ranging investments and global influence, which render the Asian behemoth a cornerstone.

The Africa-China Interplay:

Bear in mind that South Africa is an integral member of the BRICS alliance. Couple this with the reality that China has emerged as Africa’s foremost trading partner and investor. According to the most recent data from China’s General Administration of Customs, total bilateral trade between China and Africa in 2021 reached USD 254.3 billion, a 35.3 percent increase over the previous year despite the COVID-19 pandemic.

Additionally, China has furnished considerable infrastructure development loans and investments to African nations, resulting in heightened economic growth and progress. How can this chemistry influence the BRICS agenda? What happens if all African countries trade with China without the US dollar? These questions may appear distant, yet they are sufficiently intriguing to challenge our assumptions regarding the dollar’s dominance.

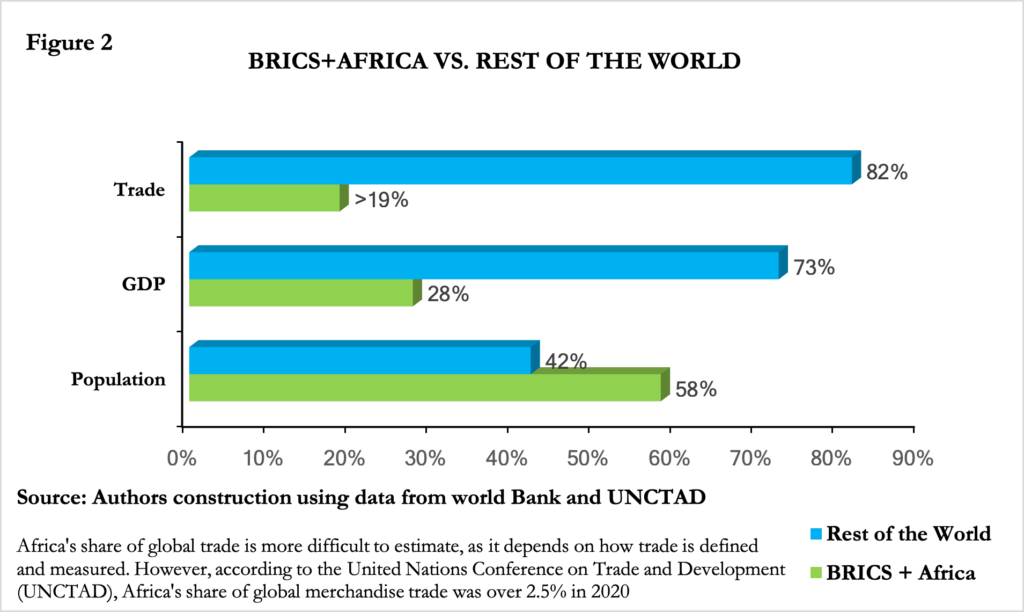

Statistically, BRICS and Africa account for a staggering 42% of the global population, making up over 19% of the world’s trade, with a combined GDP of 28% (see Figure 2). While these numbers may not be enough to “kill” the dollar, they are certainly disruptive enough to rattle the global currency landscape.

Worth Noting

As China’s influence in Africa grows, so does the potential for a seismic shift in the global economic landscape. What would happen if all African countries tried to trade with China without using the US dollar? Whether possible or not, the question raises the likelihood of a fundamental reshaping of the global currency circumstances, with significant implications for the future of international trade.

While such a scenario may seem distant, the disruptive potential of BRICS and Africa’s combined population, trade volume, and GDP cannot be underestimated. It is clear that the power dynamics of the global economy are in flux, and the only certainty is uncertainty.

Regardless, Africans ditching the dollar in their dealings with China will ensure enhanced Sino-African trade relations, with both parties benefiting from reduced transaction costs and increased efficiency.

Moreover, African nations might experience increased currency stability due to reduced exposure to US dollar fluctuations, thus promoting regional economic resilience. Of course, every rose has its thorn. This shift could also prompt an economic backlash from the US and other countries reliant on the US dollar, leading to trade disputes, tariffs, or other retaliatory measures that could impact global trade dynamics.

On the flip side, African economies might become more diversified as they explore new markets and reduce reliance on traditional trading partners. Currency risk management would become crucial, requiring effective monetary policy coordination between African nations and China as well as robust financial markets and infrastructure to support these new currency arrangements.

In summary, the decision of African countries to trade with China without using the US dollar could lead to significant changes in global economic dynamics, presenting both opportunities and challenges. While the idea of ditching the dollar may have once seemed like a far-fetched Hollywood plot, the reality is that the wheels of change are already in motion.

In conclusion, the prospect of African and BRICS nations ditching the dollar in favor of alternative currency arrangements could usher in a new era of global economic relations.

As the world watches this unfolding drama, one cannot help but wonder if the 1981 film “Rollover” foreshadowed a future now becoming a reality. In this brave new world, economic powerhouses must adapt and innovate to maintain their positions. As we stand on the precipice of change, it is crucial for policymakers, businesses, and individuals alike to remain informed and embrace the opportunities that this shift presents. After all, as the saying goes, “Fortune favors the bold.” Therefore, let us fasten our seatbelts and prepare for an exhilarating ride through the uncharted waters of global economic transformation.

Written by: Dr. Isaac Ankrah, Senior Research Fellow, ACCPA